Printable Form W 4P

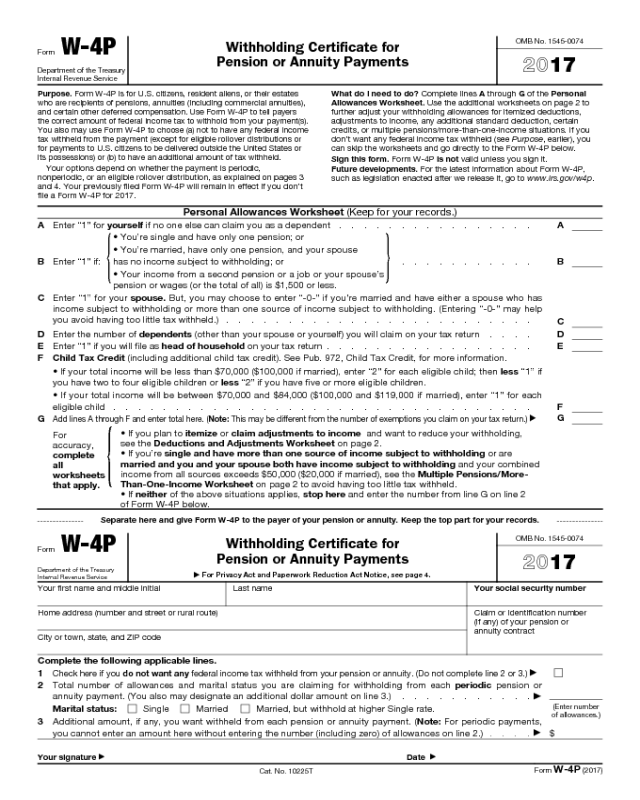

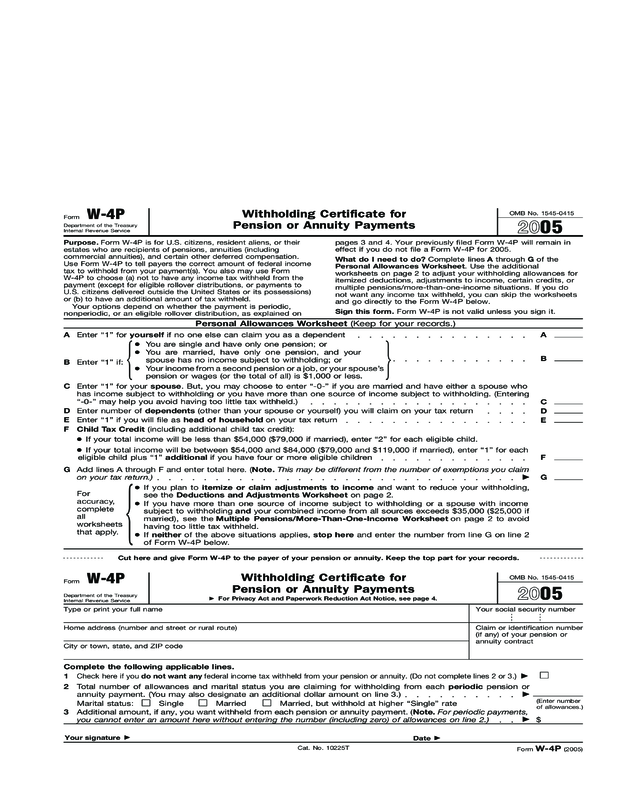

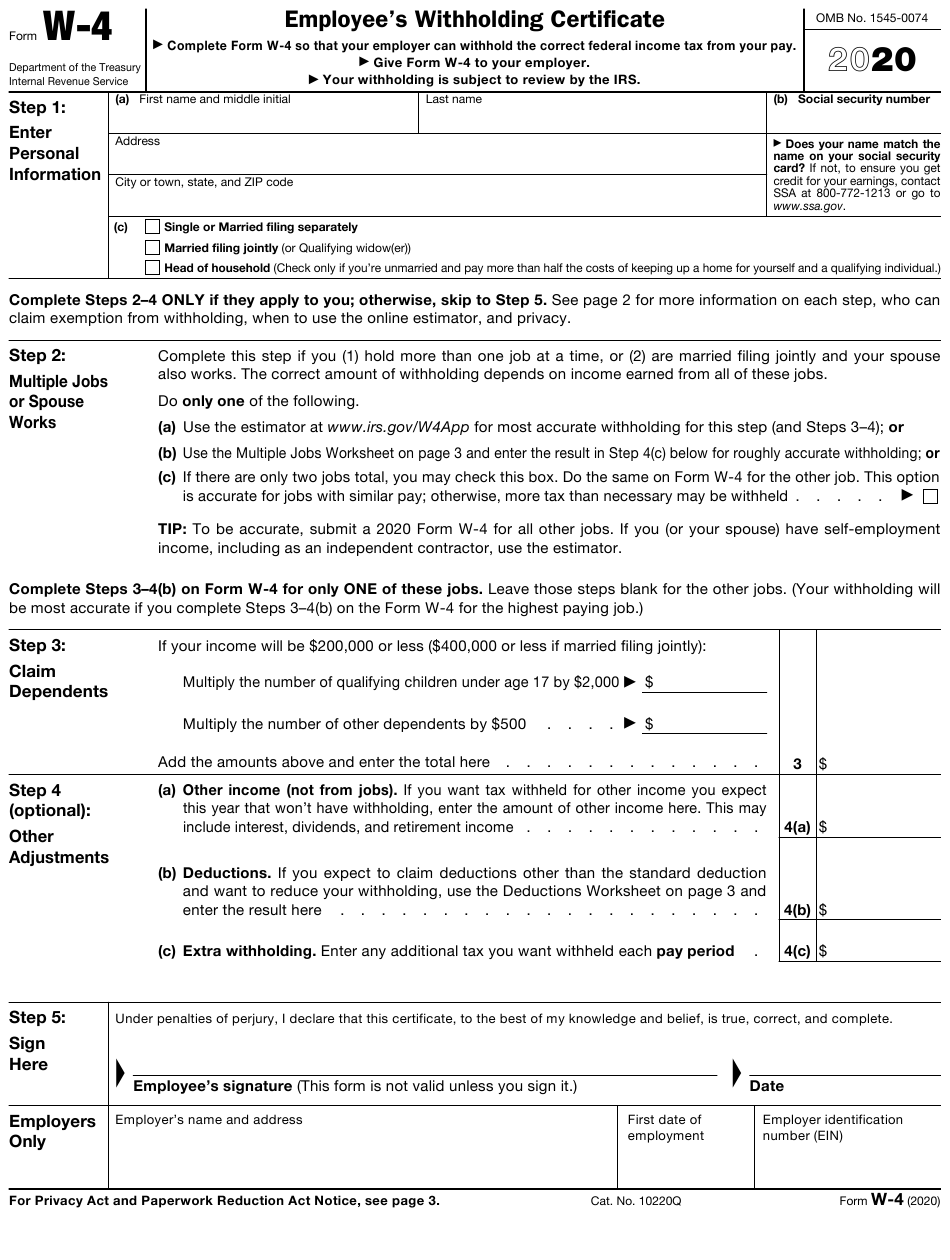

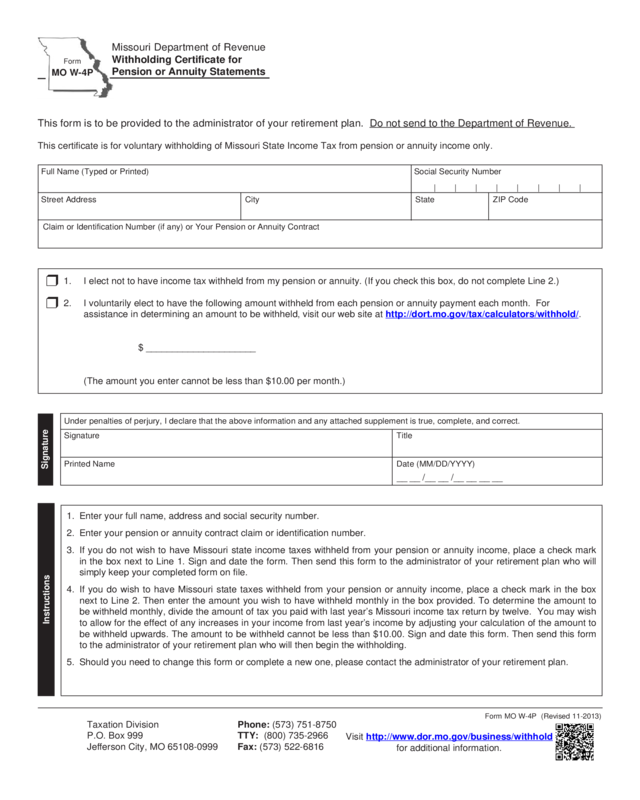

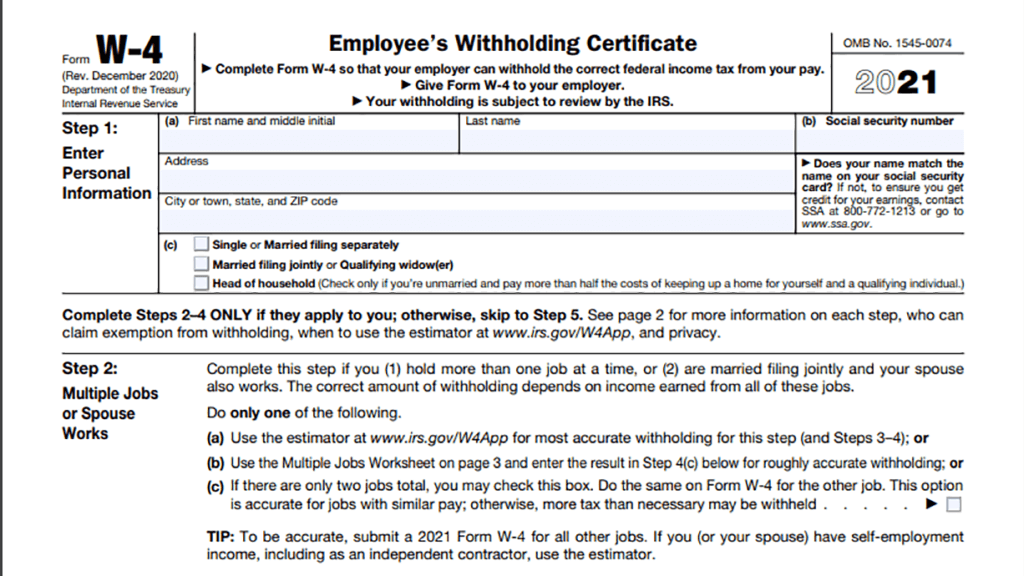

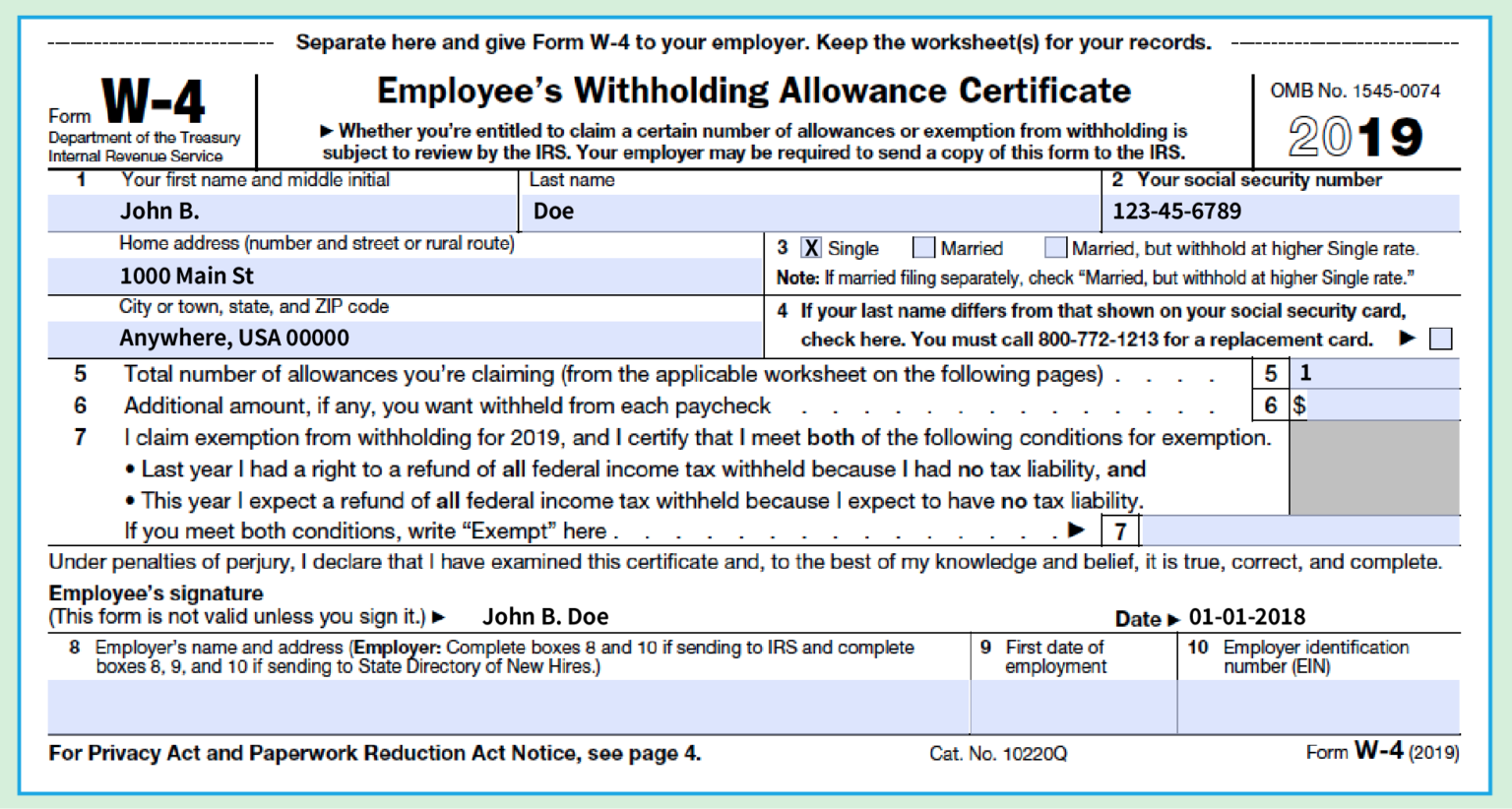

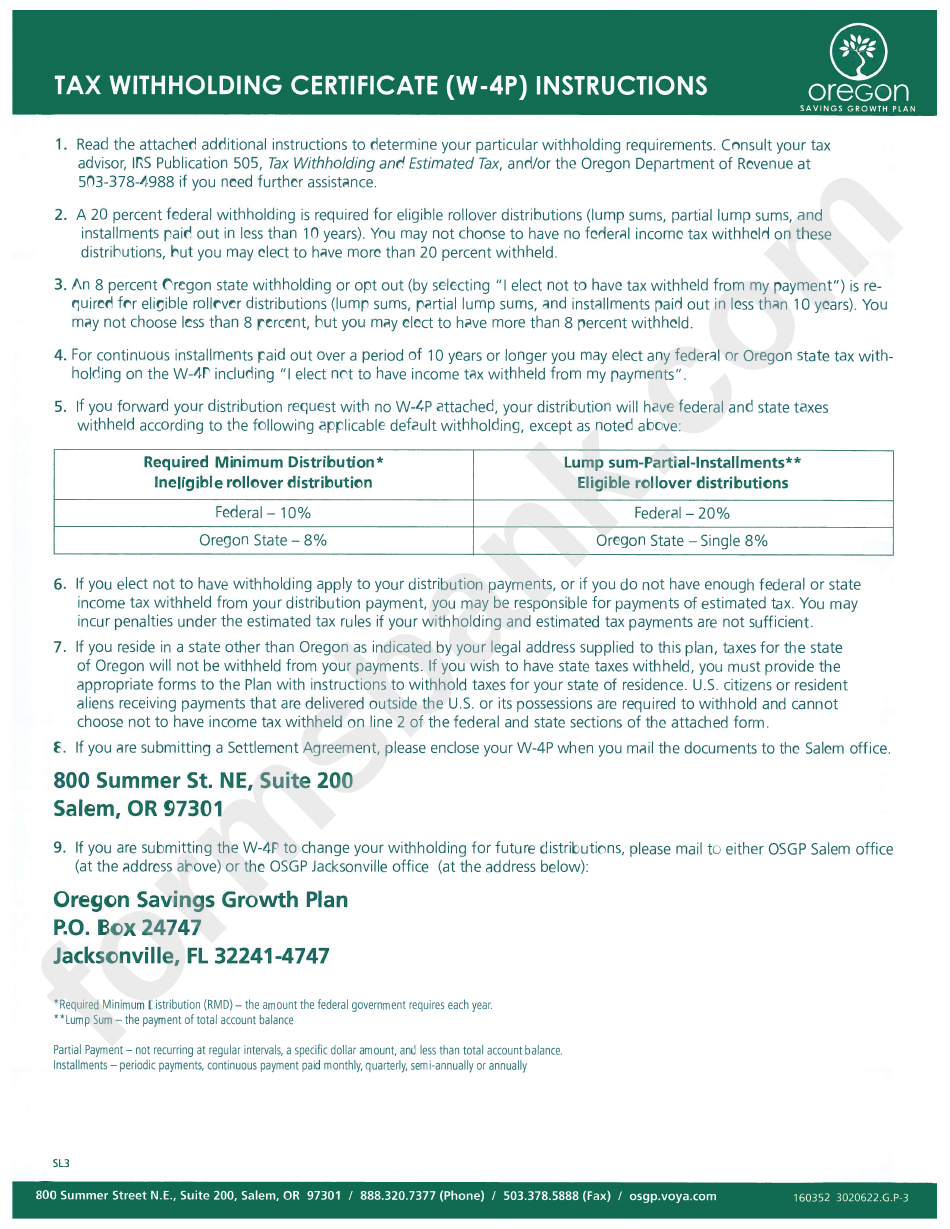

Printable Form W 4P - Web form w‐4p is for u.s. Federal income tax withholding applies to the taxable part of these payments. Printable + irs w4 calculator • 2023. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. The title of the form is.“withholding certificate for periodic pension or annuity payments”. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Federal income tax withholding applies to the taxable part of these payments. You can have income tax withheld from all of those sources of income or you can make periodic payments. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Section references are to the internal revenue code. 01 fill and edit template. Federal income tax withholding applies to the taxable part of these payments. You can have income tax withheld from all of those sources of income or you can make periodic payments. Federal income tax withholding applies to the taxable part of these payments. We incorporate all significant changes to forms posted with this coversheet. Here's how to download plus a w4p withholding calculator. This form tells them how much tax to withhold from your payments based on your personal information, income, deductions, and credits. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Also known as withholding certificate for periodic pension or annuity payments, it’s an official document for us citizens and resident aliens who receive pensions, annuities, and other deferred compensation. Printable + irs w4 calculator • 2023. Section references are to the internal revenue code. Type on screen or print out and fill in using capital letters and black ink. Federal income tax withholding applies to the taxable part of these payments. As legislation enacted after it was published, go to www.irs.gov/formw4p. Web form w‐4p is for u.s. 03 export or print immediately. Here's how to download plus a w4p withholding calculator. Web form w‐4p is for u.s. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Federal income tax withholding applies to the taxable part of these payments. Use form w‐4p to tell payers the correct amount of. This form tells them how much tax to withhold from your payments based on your personal information, income, deductions, and credits. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. 01 fill and edit template. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Web form w‐4p is for u.s. The title of the form is.“withholding certificate for periodic pension or annuity payments”. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Federal income tax. The title of the form is.“withholding certificate for periodic pension or annuity payments”. Federal income tax withholding applies to the taxable part of these payments. Web form w‐4p is for u.s. Federal income tax withholding applies to the taxable part of these payments. Person (includes resident aliens), to update your federal withholding on your periodic income annuity payments. Federal income tax withholding applies to the taxable part of these payments. Web form w‐4p is for u.s. Federal income tax withholding applies to the taxable part of these payments. Section references are to the internal revenue code. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. As legislation enacted after it was published, go to www.irs.gov/formw4p. Federal income tax withholding applies to the taxable part of these payments. Printable + irs w4 calculator • 2023. This is different than if you go to work somewhere. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. The title of the form is.“withholding certificate for periodic pension or annuity payments”. Federal income tax withholding applies to the taxable part of these payments. As legislation enacted after it was published, go to www.irs.gov/formw4p. If you need more room for information or signatures, Person (includes resident aliens), to update your federal withholding on your periodic income annuity payments. 01 fill and edit template. Do not file draft forms and do not rely on draft forms, instructions, and pubs for filing. Web form w‐4p is for u.s. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain. Section references are to the internal revenue code. This form tells them how much tax to withhold from your payments based on your personal information, income, deductions, and credits. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Web form w‐4p is for u.s. 01 fill and edit template. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. As legislation enacted after it was published, go to www.irs.gov/formw4p. The title of the form is.“withholding certificate for periodic pension or annuity payments”. 01 fill and edit template. Web form w‐4p is for u.s. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Federal income tax withholding applies to the taxable part of these payments. Web form w‐4p is for u.s. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. This form tells them how much tax to withhold from your payments based on your personal information, income, deductions, and credits. Section references are to the internal revenue code. You can have income tax withheld from all of those sources of income or you can make periodic payments. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Here's how to download plus a w4p withholding calculator. Printable + irs w4 calculator • 2023. If you need more room for information or signatures, 01 fill and edit template. The title of the form is.“withholding certificate for periodic pension or annuity payments”. 03 export or print immediately. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation.W 4P Withholding Chart

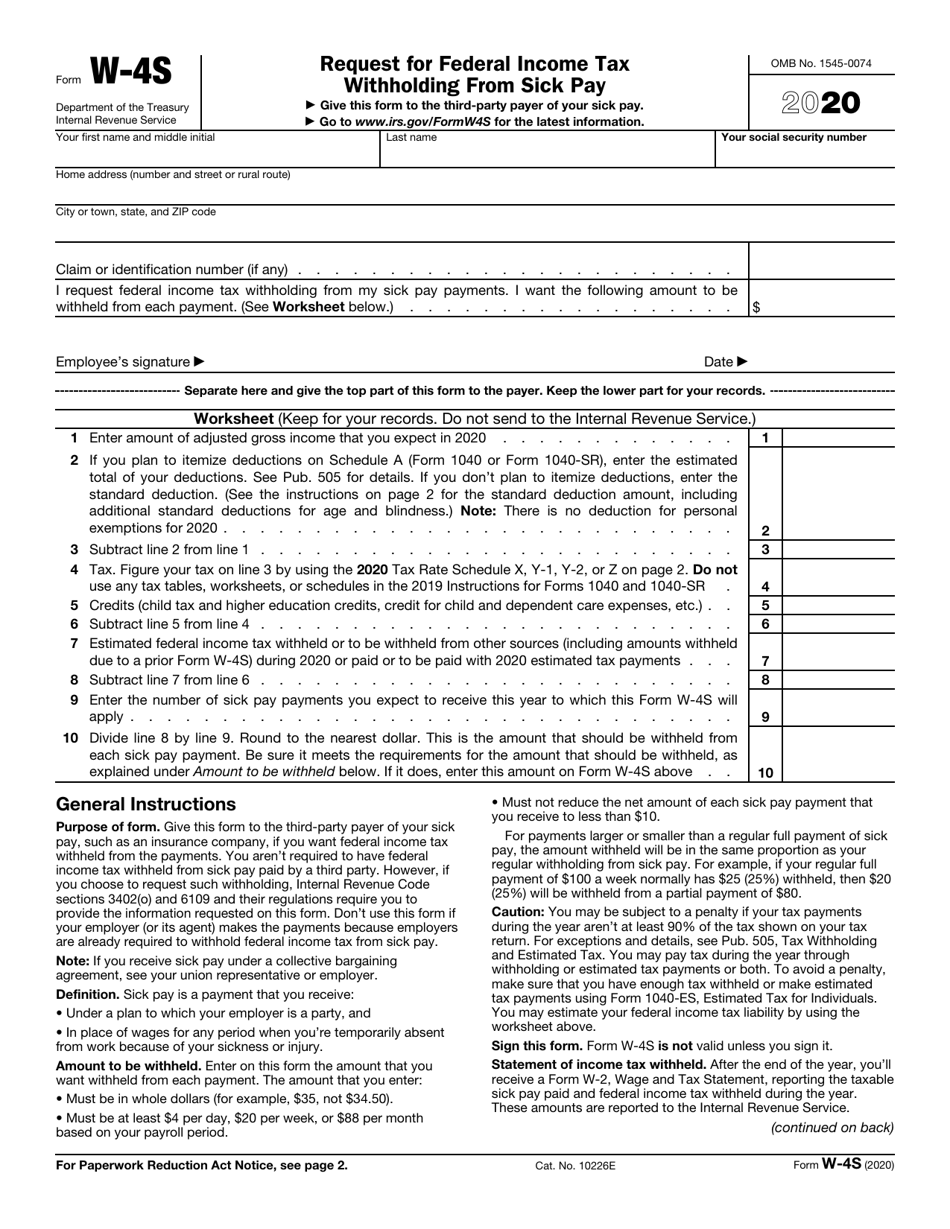

Form W4P Edit, Fill, Sign Online Handypdf

2005 Form W4P Edit, Fill, Sign Online Handypdf

Fillable Online 2020 Form W4P. Withholding Certificate for Pension or

Printable Irs Form W 4p Printable Form 2024

Federal Tax Withholding Election Form W4p

2023 Form IRS W4P Fill Online, Printable, Fillable, Blank pdfFiller

What you should know about the new Form W4 Atlantic Payroll Partners

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

Form W4p Tax Withholding Certificate printable pdf download

Web Form W‐4P Is For U.s.

We Incorporate All Significant Changes To Forms Posted With This Coversheet.

Type On Screen Or Print Out And Fill In Using Capital Letters And Black Ink.

Citizens, Resident Aliens, Or Their Estates Who Are Recipients Of Pensions, Annuities (Including Commercial Annuities), And Certain Other Deferred Compensation.

Related Post: